Wyoming Credit: Your Neighborhood Resource for Financial Security and Development

Wyoming Credit: Your Neighborhood Resource for Financial Security and Development

Blog Article

Opening the Benefits of Cooperative Credit Union: Your Guide

In the world of monetary organizations, cooperative credit union stand as a distinct and often underexplored alternative for those seeking a more tailored method to banking. As we look into the details of cooperative credit union, a world of advantages and chances unfolds, using a look into a financial landscape where area worths and member-focused solutions take spotlight. From their humble starts to their modern-day impact, understanding the significance of cooperative credit union can potentially improve the means you check out and handle your financial resources.

History of Credit Score Unions

Credit report unions have a rich background rooted in the cooperative movement, dating back to the 19th century. The principle of cooperative credit union emerged as an action to the financial needs of people who were underserved by standard financial institutions. Friedrich Wilhelm Raiffeisen, a German mayor, is frequently credited with starting the very first modern-day lending institution in the mid-1800s (Credit Union Cheyenne WY). Raiffeisen established participating loaning cultures to assist farmers and rural neighborhoods accessibility economical credit scores and get away the clutches of usurious loan providers.

The idea of people coming with each other to merge their sources and give financial aid to each various other spread swiftly across Europe and later on to North America. In 1909, the first lending institution in the United States was established in New Hampshire, noting the beginning of a brand-new age in community-focused financial. Ever since, cooperative credit union have actually continued to prioritize the economic wellness of their members over profit, personifying the participating concepts of self-help, self-responsibility, freedom, equity, equality, and uniformity.

Subscription Eligibility Standards

Having developed a structure rooted in participating principles and community-focused banking, credit report unions maintain details membership eligibility criteria to make certain positioning with their core worths and purposes. These requirements commonly rotate around a common bond shared by prospective participants, which might include variables such as geographic location, company, organizational association, or membership in a details area or organization. By requiring members to fulfill specific qualification needs, cooperative credit union aim to promote a sense of belonging and shared objective among their participants, reinforcing the cooperative nature of these banks.

Along with usual bonds, some cooperative credit union might likewise expand membership qualification to member of the family of present participants or individuals who stay in the exact same family. This inclusivity assists cooperative credit union expand their reach while still staying real to their community-oriented principles. By preserving transparent and clear membership requirements, lending institution can make sure that their members are actively participated in supporting the participating worths and objectives of the institution.

Financial Services And Products

When thinking about the selection of offerings offered, credit report unions supply a varied array of financial products and solutions customized to satisfy the special needs of their members. These offerings generally include savings and checking accounts, loans (such as automobile car loans, personal fundings, and home loans), credit history cards, and various investment alternatives. One essential benefit of cooperative credit union is their concentrate on offering address competitive rate of interest and reduced costs contrasted to conventional financial institutions. Members commonly check over here gain from personalized customer support, as lending institution prioritize building strong connections with those they serve.

Furthermore, lending institution regularly offer financial education and counseling to aid participants boost their monetary literacy and make educated choices. Lots of lending institution also participate in shared branching networks, enabling members to access their accounts at a variety of places nationwide. Overall, the range of economic services and products provided by credit history unions highlights their commitment to satisfying the varied requirements of their participants while prioritizing their financial wellness.

Advantages Over Standard Banks

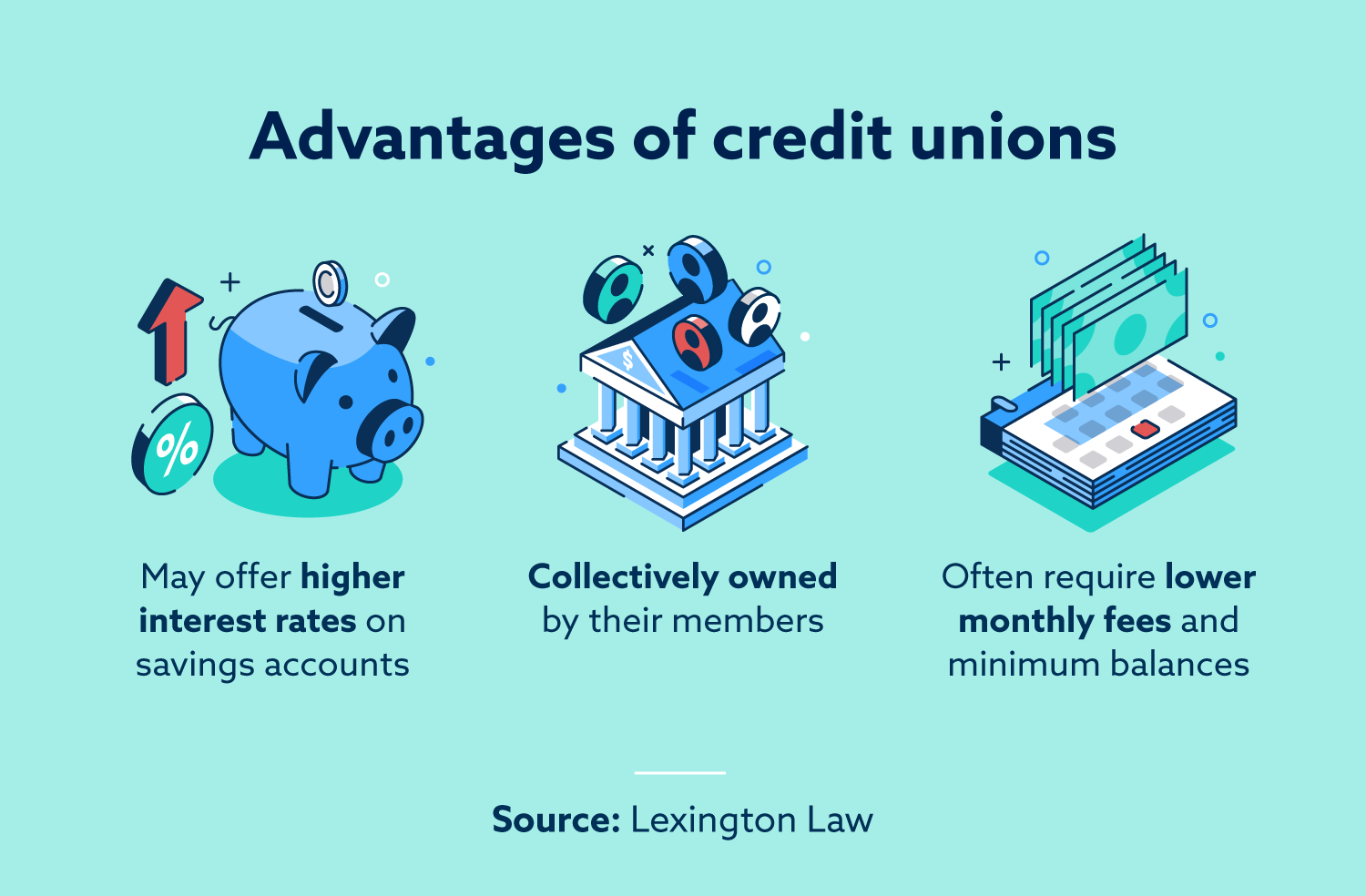

Showing a distinctive approach to economic solutions, credit rating unions provide numerous advantages over standard financial institutions. In addition, debt unions are recognized for their competitive interest rates on financial savings accounts, fundings, and credit rating cards.

Additionally, cooperative credit union tend to have a strong emphasis on economic education and community assistance. They usually offer resources and workshops to help members enhance their monetary literacy and make sound cash management choices (Credit Union Cheyenne WY). By cultivating a feeling of neighborhood and shared objectives, credit scores unions can develop a much more inclusive and encouraging financial environment for their participants

Area Participation and Social Influence

Additionally, credit score unions often partner with local organizations and charities to sustain various social causes such as budget-friendly real estate, education and learning, and healthcare. By teaming up with these entities, credit rating unions can intensify their social impact and address critical issues affecting their communities. This collective technique not read this article only benefits those in need but likewise strengthens the social fabric of the neighborhood by cultivating a sense of unity and assistance among its participants. Fundamentally, lending institution work as stimulants for positive change, driving community development and social progression through their active involvement and impactful efforts.

Verdict

Finally, lending institution have a rich history rooted in community and cooperation, supplying a diverse variety of financial services and products with affordable prices and personalized customer solution. They focus on the monetary health of their members over profit, cultivating a sense of belonging and offering economic education and learning. By proactively participating in social effect initiatives, cooperative credit union develop a encouraging and inclusive banking setting that makes a favorable difference in both individual lives and areas.

Friedrich Wilhelm Raiffeisen, a German mayor, is often attributed with starting the initial modern credit report union in the mid-1800s - Wyoming Credit Unions. By requiring participants to meet certain qualification requirements, credit history unions intend to promote a sense of belonging and shared function amongst their participants, strengthening the participating nature of these monetary institutions

In addition, credit score unions frequently offer monetary education and learning and counseling to assist participants boost their financial literacy and make informed decisions. Overall, the variety of monetary items and solutions supplied by credit scores unions underscores their commitment to meeting the varied requirements of their participants while prioritizing their financial well-being.

Furthermore, credit score unions are known for their affordable passion rates on savings accounts, car loans, and credit report cards.

Report this page